The Ultimate Guide to PoW and PoS Coins: Strategies and Philosophies for Investment

The Ultimate Guide to PoW and PoS Coins

The Ultimate Guide to PoW and PoS Coins: Strategies and Philosophies for Investment

Blockchain technology has revolutionized the way we think about money, security, and decentralized systems. Two key mechanisms that underpin blockchain networks are Proof of Work (PoW) and Proof of Stake (PoS). These consensus algorithms are not just technical jargon; they’re at the heart of how cryptocurrencies function and can influence your investment strategy. Let’s dive into what PoW and PoS coins are, how they differ, and how you can shape your investment philosophy around them.

What Are PoW Coins?

Proof of Work (PoW) coins rely on a computationally intensive process called mining to validate transactions and secure the blockchain. Miners compete to solve complex cryptographic puzzles, and the first one to solve it gets to add a block to the blockchain and earn rewards (block rewards and transaction fees).

Popular PoW Coins

- Bitcoin (BTC): The original cryptocurrency and the most popular PoW coin. Known for its robust security and decentralization.

- Litecoin (LTC): Often referred to as the "silver to Bitcoin’s gold," it’s faster and more affordable for transactions.

- Dogecoin (DOGE): A lighthearted PoW coin that gained massive popularity thanks to its community and memes.

- Monero (XMR): A privacy-focused coin that ensures anonymous transactions.

- Ethereum Classic (ETC): A split from Ethereum, retaining PoW after Ethereum transitioned to PoS.

Key Characteristics of PoW Coins

- Security: High computational effort makes it incredibly secure and resistant to attacks.

- Energy-Intensive: Mining requires significant energy, leading to criticisms about environmental impact.

- Decentralization: PoW networks like Bitcoin have a broad mining base, ensuring decentralization.

What Are PoS Coins?

Proof of Stake (PoS) coins take a more energy-efficient approach. Instead of mining, participants lock up (stake) their cryptocurrency to validate transactions and secure the network. Validators are chosen based on the amount of cryptocurrency they stake and, often, an element of randomness.

Popular PoS Coins

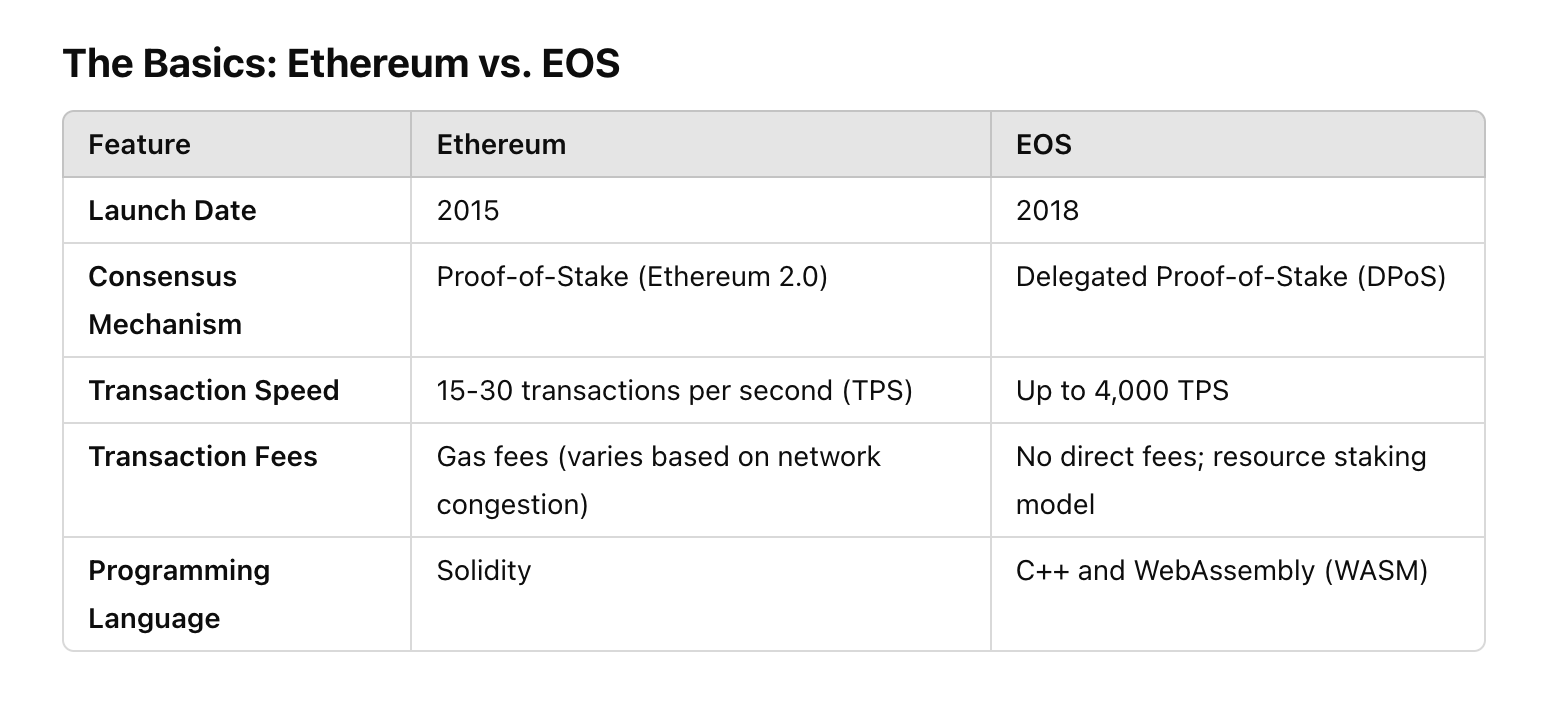

- Ethereum (ETH): Transitioned from PoW to PoS with Ethereum 2.0, reducing its energy consumption significantly.

- Cardano (ADA): Focuses on scalability and sustainability with its Ouroboros protocol.

- Polkadot (DOT): Aims to enable interoperability between different blockchains.

- Solana (SOL): Known for high-speed transactions and low fees.

- Tezos (XTZ): Offers self-amending governance and high adaptability.

Key Characteristics of PoS Coins

- Energy Efficiency: Doesn’t require massive computational power, making it eco-friendly.

- Accessibility: Easier for users to participate by staking coins rather than acquiring expensive mining equipment.

- Scalability: Often more scalable than PoW networks due to their design.

Investing Based on PoW and PoS Philosophies

When deciding whether to invest in PoW or PoS coins, it’s essential to understand the underlying technology, philosophies, and potential use cases.

PoW Investment Philosophy

- Long-Term Store of Value:

- PoW coins like Bitcoin are often viewed as "digital gold," suitable for long-term investment due to their security and decentralization.

- Scarcity and Proven Track Record:

- Bitcoin’s capped supply (21 million coins) makes it deflationary and attractive to those who value scarcity.

- Belief in Decentralization:

- PoW systems are often more decentralized, which appeals to investors prioritizing security and trustlessness.

PoS Investment Philosophy

- Passive Income:

- Many PoS coins allow investors to earn rewards by staking their holdings. This makes them attractive for those seeking yield-generation strategies.

- Eco-Conscious Investing:

- With growing concerns about environmental sustainability, PoS coins align with investors looking for greener technologies.

- Scalability and Innovation:

- PoS coins like Ethereum and Solana are designed for high transaction throughput and innovative decentralized applications (dApps).

Strategies for Investing in PoW and PoS Coins

Diversification

A balanced portfolio might include both PoW and PoS coins to leverage the strengths of each:

- PoW Coins: Provide stability, security, and a long-term store of value.

- PoS Coins: Offer growth potential, staking rewards, and eco-friendly alternatives.

Research the Use Cases

- Invest in coins with strong fundamentals and real-world applications.

- For example, Ethereum’s dominance in smart contracts and dApps makes it a favorite among PoS coins.

Participate in Staking

- By staking PoS coins, investors can earn passive income and potentially offset price volatility.

- Tools like Binance, Coinbase, or native wallets simplify staking for beginners.

Monitor Network Health

- For PoW coins, check metrics like hash rate and miner activity.

- For PoS coins, evaluate staking participation, validator distribution, and governance.

Conclusion

The choice between PoW and PoS coins depends on your investment goals, risk tolerance, and beliefs about the future of blockchain technology. PoW coins like Bitcoin provide stability and a proven track record, while PoS coins like Ethereum and Cardano offer scalability, innovation, and eco-friendliness.

By understanding the philosophies behind these mechanisms and tailoring your strategy accordingly, you can position yourself for success in the ever-evolving world of cryptocurrency investments.

Enroll in a ProfitPulse course and gain the skills, confidence, and knowledge to succeed.