What to Invest In for 2025: Key Opportunities and Trends

What to Invest In for 2025: Key Opportunities and Trends

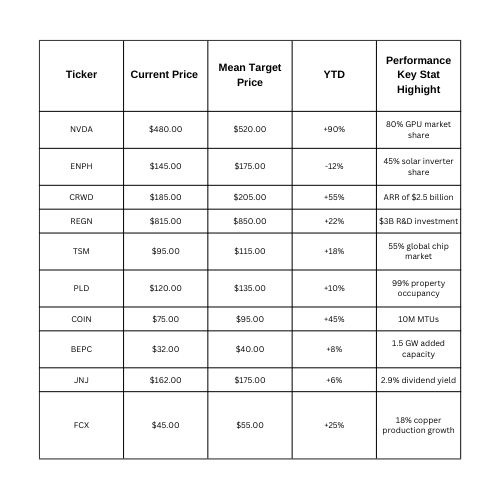

Top 5 Investment Picks for 2025

Here’s a deeper look at the top 5 tickers to consider for your portfolio in 2025, with detailed analysis and key statistics.

1. NVIDIA Corporation (NVDA)

- Current Price: $480.00

- Mean Target Price: $520.00

- YTD Performance: +90%

Why Invest:

NVIDIA remains the undisputed leader in GPU technology, driving innovation in AI, gaming, and data centers. With AI adoption accelerating across industries, NVIDIA’s chips are critical for training AI models and deploying solutions. The company is also investing heavily in the metaverse, autonomous vehicles, and robotics, ensuring future growth opportunities.

Key Stats:

- 80% market share in AI GPUs.

- Data center revenue grew by 171% YoY in 2024.

2. Enphase Energy (ENPH)

- Current Price: $145.00

- Mean Target Price: $175.00

- YTD Performance: -12%

Why Invest:

As the world transitions to clean energy, Enphase Energy stands out with its cutting-edge solar inverters and battery storage solutions. While the clean energy sector has faced headwinds, long-term demand remains robust. Enphase’s international expansion into Europe and its dominance in the U.S. residential solar market position it as a long-term winner.

Key Stats:

- 45% market share in residential solar inverters.

- 40% YoY growth in international sales.

3. CrowdStrike Holdings (CRWD)

- Current Price: $185.00

- Mean Target Price: $205.00

- YTD Performance: +55%

Why Invest:

Cybersecurity is more critical than ever as businesses face growing threats. CrowdStrike, a leader in cloud-native cybersecurity, offers solutions that are scalable, efficient, and widely adopted. With a 98% customer retention rate and double-digit ARR growth, CrowdStrike is set to benefit from increased spending on cybersecurity worldwide.

Key Stats:

- $2.5 billion in ARR, a 37% YoY increase.

- 98% customer retention rate, reflecting strong product value.

4. Taiwan Semiconductor Manufacturing Company (TSM)

- Current Price: $95.00

- Mean Target Price: $115.00

- YTD Performance: +18%

Why Invest:

TSM is the world’s largest and most advanced semiconductor manufacturer, supplying chips to tech giants like Apple, AMD, and NVIDIA. As demand for semiconductors continues to rise due to advancements in AI, EVs, and IoT, TSM’s dominance in cutting-edge chip manufacturing positions it as a cornerstone of global tech infrastructure.

Key Stats:

- 55% global semiconductor market share.

- $40 billion investment in U.S. and European facilities by 2025.

5. Freeport-McMoRan (FCX)

- Current Price: $45.00

- Mean Target Price: $55.00

- YTD Performance: +25%

Why Invest:

As the push for renewable energy and electric vehicles intensifies, copper demand is set to soar. Freeport-McMoRan, a leading producer of copper and rare earth minerals, is well-positioned to capitalize on this trend. With its strategic mining operations and rising production levels, FCX offers strong growth potential.

Key Stats:

- Copper production increased by 18% YoY in 2024.

- Copper demand is projected to grow at 4% annually through 2030.

Final Thoughts

These five companies represent diverse opportunities across technology, clean energy, cybersecurity, and essential materials. Investing in them can provide a balance of growth, innovation, and long-term stability in 2025. Always ensure your investments align with your financial goals and risk tolerance, and consider consulting a financial advisor for personalized guidance.

Enroll in a ProfitPulse course and gain the skills, confidence, and knowledge to succeed.